크루드 오일이란

크루드오일 전망

크루드오일 실시간

크루드오일 wti

크루드오일 주가

크루드오일 선물

크루드오일 증거금

국제유가 속보

주제에 대한 기사를 찾고 있습니까 “크루 드 오일“? 웹사이트에서 이 주제에 대한 전체 정보를 제공합니다 c2.castu.org 탐색에서: 974 사진을 다운로드할 수 있는 최고의 웹사이트. 바로 아래에서 이 주제에 대한 자세한 답변을 찾을 수 있습니다. 찾고 있는 주제를 더 잘 이해하려면 끝까지 읽으십시오.

이미지를 휴대폰에 다운로드하려면 이미지를 2초 동안 두 번 클릭한 다음 “이미지 다운로드” 다운로드를 선택하여 이미지를 다운로드할 수 있습니다.

컴퓨터에서 이미지를 다운로드하려면 이미지를 클릭한 다음 “다른 이름으로 이미지 저장”을 선택하여 다운로드할 수 있습니다.

Table of Contents

크루 드 오일 주제와 관련된 상위 131 이미지

주제 크루 드 오일 와 관련된 24 개의 이미지가 있습니다.

크루드 오일 선물(Crude Oil Futures)과 거래 가격

크루드 오일 선물(Crude Oil Futures) 크루드 오일 선물은 서부 텍사스산 중질류(West Texas Intermediate)를 기초 자산으로 하는 선물 상품이다. 해외선물을 거래하는 국내 투자자라면 미니 나스닥 100 선물, 금 선물과 더불어 크루드 오일 선물은 중요한 거래 상품으로 뉴욕상업거래소(NYMEX)에 상장되어 있다. 선물 거래 단위와 가격 오일은 1배럴(158.9리터)을 기준으로 거래를 하며 크루드 오일 선물의 1계약은 1,000 배럴을 기준으로 한다. 선물 가격의 최소 가격 변동 단위를 ‘틱’이라고 하는데 크루드 오일의 틱은 0.01이며 선물 1계약이 1,000배럴이기에 0.01 x 1000 = 10 즉, 1틱당 10달러의 가치를 지니고 있다. 급격한 가격 변동으로 크루드 오일 ..

- Image source: doubletoin.kr

- Views: 11689

- Publish date: 9 hours ago

- Downloads: 9313

- Likes: 8784

- Dislikes: 1

크루드 오일 가격은 국제 정치, 경제 상황에 영향을 받는데 작년에 있었던 사우디 원유시설 드론 공격으로 원유 가격이 급등한 것도 한 예이다. 특히, 오일 재고량 발표는 급격한 가격 변동을 일으켜서 투자자들의 희비를 엇갈리게 한다. 원유 재고량 발표를 쉽게 볼 수 있는 내용은 아래 링크를 참조하면 된다.

크루드 오일 선물을 매매하려면 얼마가 있어야 할까? 캡처했을 당시 가격은 40.71 이었다. 선물 1계약이 1천 배럴이므로 40.71 x 1000 = 40,710 달러 한화로 최소 4,650만 원 이상이 있어야 한다. 그런데 선물은 개시 증거금만 있어도 매매를 할 수 있는데 이베스트 증권사를 통해 보면

ntermediate)를 기초 자산으로 하는 선물 상품이다. 해외선물을 거래하는 국내 투자자라면 미니 나스닥 100 선물, 금 선물과 더불어 크루드 오일 선물은 중요한 거래 상품으로 뉴욕상업거래소(NYMEX)에 상장되어 있다.

goldman sachs: Fundamentals for crude oil weaken, witness 1st surplus since June 2020: Goldman Sachs – The Economic Times

- Image source: economictimes.indiatimes.com

- Views: 60845

- Publish date: 52 minute ago

- Downloads: 93942

- Likes: 7308

- Dislikes: 3

Fundamentals for crude oil weakened in April-May with modest declines in the Russian exports, record large sales by Strategic Petroleum Reserve and severe Chinese lockdowns bringing the oil market to its first surplus since June 2020, said multinational investment and financial services firm Goldman Sachs in a report.

“Oil’s structural deficit therefore remains unresolved, with in fact an even tighter oil market through April than we had expected. Supply remains inelastic to higher prices with core-OPEC (higher) and exempt countries (lower) production shifts broadly offsetting.”

“Chinese demand is recovering, yet we remain conservative on its further normalisation. The government’s push for achieving robust growth this year, therefore leaves risk to our downgraded Chinese demand expectation as skewed to the upside,” the report said.

- Image source: kr.investing.com

- Views: 31926

- Publish date: 21 hours ago

- Downloads: 81759

- Likes: 9836

- Dislikes: 10

What Is Crude Oil?

Crude oil is a liquid fossil fuel with broad impacts on the economy. Learn the types of crude oil and how to invest in them.

- Image source: www.thebalancemoney.com

- Views: 77072

- Publish date: 14 hours ago

- Downloads: 3836

- Likes: 3991

- Dislikes: 3

:max_bytes(150000):strip_icc()/GettyImages-1215993819-2ae40f5bbb744d0b94ba07eb5d7bd4f6.jpg)

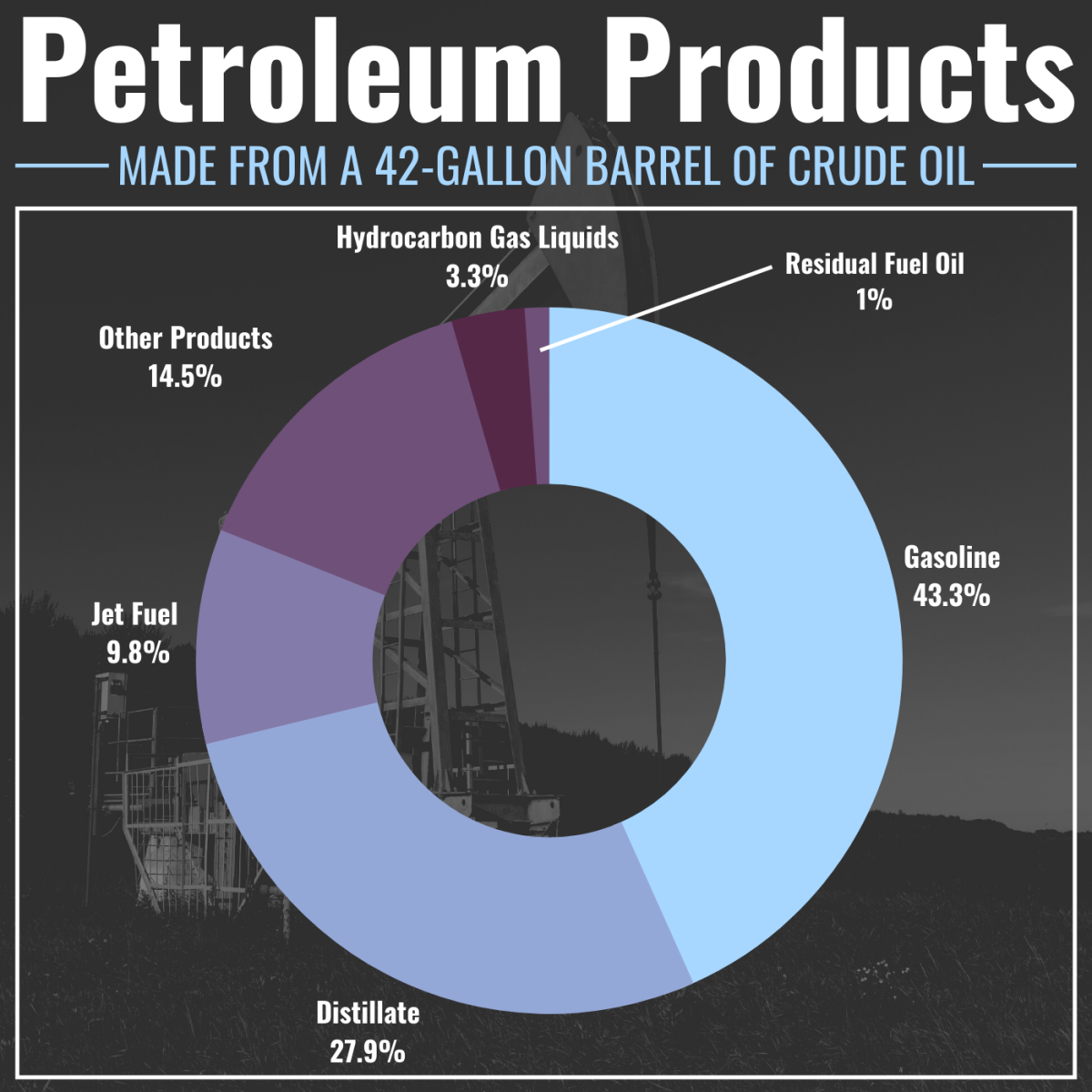

In 2021, the United States produced 4.1 billion barrels of crude oil. Each 42-gallon barrel of oil produces roughly 45 gallons worth of petroleum products due to refinery processing gain. The output is higher than the input because the oil products that are processed have a lower specific gravity than the processed oil. Gasoline is the most commonly produced petroleum product, and about 19 to 20 gallons of gas are produced from each barrel of crude oil.

for crude oil is reported in almost every major U.S. news outlet. It is the value of 1,000 barrels of oil at some agreed-upon time in the future. The oil is commonly WTI. In this way, the NYMEX forecasts what oil traders think the WTI spot price will be in the future. But the futures price follows the spot price pretty closely since the oil traders can’t know about sudden disruptions to the oil supply.

Oil exchange-traded funds are easier to invest in than oil futures. They follow the prices of oil futures, but they are just as volatile. Some oil ETFs follow the stocks of oil companies. Their prices are affected by both oil prices and the stock market. Even if oil prices are rising, the ETF prices could fall if investors pull funds from the oil companies’ stocks.

crude oil price: Crude oil futures rise on spot demand, global cues – The Economic Times

- Image source: economictimes.indiatimes.com

- Views: 47875

- Publish date: 23 hours ago

- Downloads: 6941

- Likes: 4198

- Dislikes: 9

Torrent Investments on Friday proposed to pay its entire bid of ₹8,640 crore upfront for acquiring Anil Ambani-promoted Reliance Capital, doubling its immediate payment offer made a day after the auction ended late in December, two people aware of the development told ET.

The Reserve Bank of India (RBI) is said to have put on hold licensing of the New Umbrella Entity (NUE) network, a fintech institution planned as a rival to National Payments Corporation of India (NPCI).

If the absolute fiscal deficit will be, as projected, at ₹16.6 lakh crore, the higher growth will depress the gap to 6.1% of GDP in FY23, compared with the 6.4% estimated in the budget.

What Is Crude Oil and How Can You Invest? – TheStreet

What Is Crude Oil? Crude oil, or petroleum, is a hydrocarbon formed by the decay of large amounts of dead organisms such as plants, algae, and bacteria packed

- Image source: www.thestreet.com

- Views: 64239

- Publish date: 44 minute ago

- Downloads: 55706

- Likes: 7170

- Dislikes: 4

Crude oil is split into two categories based on its sulfur content: sweet and sour. It is also broken down into two categories based on density: light and heavy. Crude with lower sulfuric content would be classified as sweet and fetch a price higher than sour because low sulfuric content makes refining and processing the crude into petroleum products, such as gasoline and diesel, easier. The ideal crude mixture is light sweet, which is usually the type used for West Texas Intermediate (WTI), the American oil quality benchmark, and Brent, a benchmark widely used in Europe.

The largest petroleum reserves can be found in Venezuela, Saudi Arabia, Canada, Iran, Iraq, and Russia. Some countries with the largest reserves are part of a league known as the Organization of the Petroleum Exporting Countries (OPEC), which controls almost 80 percent of the world’s proven oil reserves. Together, the group of 13 nations seeks to regulate crude oil production (and consequently pricing), and their influence has geopolitical impacts, especially in countries such as the U.S. and China that have high oil demand.

Crude oil prices are dependent on supply and demand, making it a highly speculative form of investment. Oil prices briefly went negative during April 2020, at the start of the COVID-19 pandemic in the U.S. on the view that decreased activity would lead to an oversupply. Conversely, oil reached its highest prices, more than $145 a barrel, in July 2008, when demand was seen as high amid a stagnation in global production, but dropped by more than half in the months afterward as speculation eased.

- Image source: www.vanguardngr.com

- Views: 41542

- Publish date: 50 minute ago

- Downloads: 12109

- Likes: 6821

- Dislikes: 1

Crude oil spikes; what should investors do with BPCL, HPCL, IOC, ONGC & Gail?

Any further rise in crude prices may have an impact on the fiscal deficit situation of India amid fall in rupee against the US Dollar.

- Image source: www.moneycontrol.com

- Views: 79766

- Publish date: 3 hours ago

- Downloads: 97388

- Likes: 4477

- Dislikes: 8

“Media reports indicate 2.0-2.3m b/d of output would be restored by 16-Sep’19 but restoring the entire output would take weeks. We believe there is enough crude inventory and spare capacity to supply markets if entire production is restored within a few weeks,” ICICI Securities said in a report.

“Sharp jump in global crude prices may also put pressure on refining margins amid slowing demand, besides increasing the absolute quantum of fuel and loss. On the other hand, higher crude prices may be construed positively for upstream PSUs and GAIL,” it said.

The brokerage firm does not rule out moderation in marketing margins on auto fuels—a US$10/bbl rise in global crude and product prices may require OMCs to increase the retail price of diesel and gasoline by Rs5-6/litre in the following fortnight.

How High Crude Oil Prices Affect the Indian Economy

With crude oil prices hitting a 7-year high, there will be a severe impact on the Indian economy, especially in terms of inflation and the value of the rupee.

- Image source: www.outlookindia.com

- Views: 36336

- Publish date: 23 minute ago

- Downloads: 79573

- Likes: 6170

- Dislikes: 3

Rising crude oil prices will also have a positive impact on the Indian economy. Revenue collection from the petroleum sector has been high for both the centre and the states. The centre got Rs 2.87 trillion and Rs 4.2 trillion, respectively, in FY20 and FY21. “Higher crude price will mean higher revenue for the states under unchanged excise duty conditions. Thus, with crude prices going up, the subsidy on LPG and kerosene will be high subsequently, though this may not be very significant,” adds Madan Sabnavis, chief economist of the research team.

Since the outbreak of Covid-19, there has been a fall in India’s total oil import. Oil import accounted for nearly 27 per cent of India’s total imports in FY19 and fell to 21 per cent in FY21. Although there has been a slight rise in FY22, it is yet to get back to the pre-pandemic level. “We estimate that a 10 per cent hike in oil prices lead to an increase of India’s current account deficit (CAD) by nearly $15 billion or 0.4 per cent of GDP. This will have a negative impact on INR,” says the report.

The report mentions that there was a growing demand for oil worldwide even in pre-pandemic times, but the supply was not up to the mark. The report quoted the International Energy Agency (IEA) saying that there is still a shortage of nearly 1 million barrels per day worldwide. This imbalance between demand and supply of oil coupled with various other geopolitical tensions resulted in the spike in price finds the report.

Benchmark (crude oil) – Wikipedia

- Image source: en.wikipedia.org

- Views: 65724

- Publish date: 5 hours ago

- Downloads: 108331

- Likes: 2450

- Dislikes: 8

becoming the world’s most liquid form for crude oil trading, as well as the world’s largest-volume futures contract trading on a physical commodity. Additional risk management and trading opportunities are offered through options on the futures contract; calendar spread options; crack spread options on the pricing differential of

For many years, most of the oil producers in the Middle East have taken the monthly spot price average of Dubai and Oman as the benchmark for sales to the Far East (WTI and Brent futures prices are used for exports to the Atlantic Basin). In July 2007, a potential new mechanism arose in the form of the

Dubai’s only refinery, at Jebel Ali, takes condensates as feedstocks, and therefore all of Dubai’s crude production is exported. For many years it was the only freely traded oil in the Middle East, but gradually a spot market has developed in Omani crude as well.

Crude oil set for worst losing run since 2020 on slowdown concerns – The Hindu BusinessLine

Crude oil has shed more than 6 per cent in August as sentiment hit following contraction in global growth even as central banks tighten policy

- Image source: www.thehindubusinessline.com

- Views: 55611

- Publish date: 38 minute ago

- Downloads: 39282

- Likes: 4535

- Dislikes: 4

Oil’s decline in August marks the latest chapter in what’s been a tumultuous year, with prices driven higher in the first half by Russia’s invasion of Ukraine, then undermined as central banks shifted tack and Moscow managed to keep most exports flowing. Crude’s recent slump prompted OPEC+ heavyweight Saudi Arabia to raise the possibility the alliance could cut output, although Russian media reported the grouping wasn’t discussing such a move at present.

West Texas Intermediate, which traded above $92 a barrel after tumbling on Tuesday, has shed more than 6 per cent in August, hitting the lowest since January mid-month. In the US, the Federal Reserve has been raising rates aggressively to quell inflation, while Europe is gripped by an energy crisis that may herald a recession. In Asia, growth in China, the top oil importer, has slowed.

Commodities including crude oil have also faced a headwind this month from gains in the dollar, which makes raw materials more expensive for holders outside the US. The Bloomberg Dollar Spot Index has climbed by more than 2 per cent in August as the Federal Reserve commits to higher interest rates, with the gauge approaching a record high that was hit in July.

dayya 의 NYMEX:CLG2019 용 크루드오일 복기 — TradingView

- Image source: kr.tradingview.com

- Views: 6246

- Publish date: 32 minute ago

- Downloads: 68341

- Likes: 7578

- Dislikes: 7

출렁임이 좀 있었지만 46.38에 정확하게 진입해서 목표가까지 깔끔하게 청산나갔습니다.

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은

중간중간 단타 자리도 몇번 노려서 수익냈지만.. 기본적인 틀만 남겨봅니다.

비디오 크루 드 오일 해외선물 크루드오일 매매기법 (추세와 진입하는 방법)

- Source: Youtube

- Views: 104269

- Date: 20 minute ago

- Download: 82319

- Likes: 5793

- Dislikes: 5

주제에 대한 관련 정보 크루 드 오일

Bing에서 크루 드 오일 주제에 대한 최신 정보를 볼 수 있습니다.

크루드 오일이란

크루드오일 전망

크루드오일 실시간

크루드오일 wti

크루드오일 주가

크루드오일 선물

크루드오일 증거금

국제유가 속보

주제에 대한 기사 보기를 마쳤습니다 크루 드 오일. 이 기사가 유용했다면 공유하십시오. 매우 감사합니다.

크루드 오일이란

크루드오일 전망

크루드오일 실시간

크루드오일 wti

크루드오일 주가

크루드오일 선물

크루드오일 증거금

국제유가 속보